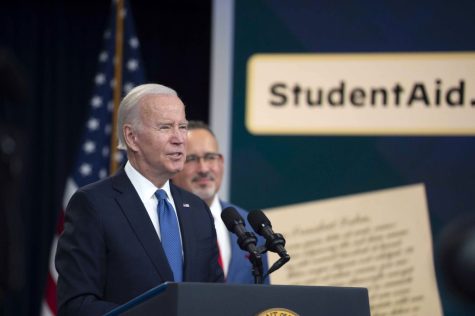

President Biden’s Debt Relief Plan

President Biden’s debt plan includes student loan forgiveness of up to $20,000. With economic challenges, the Biden-Harris Administration extended the student loan repayment pause numerous times and will pause it through December 31, 2022, and will resume in January 2023. For smooth transition back to repayment once payments start back up again, the US Department of Education will provide $20,000 in debt cancellation to Dell Grant recipients with loans held by the Department of Education and up to $10,000 in debt cancellation to non-Dell Grant recipients. Borrowers are eligible for this relief if their income is less than $125,000 or $200,000 for households. In addition, borrowers employed by nonprofits, the military, or Federal, state, Tribal, or local government may be eligible to have their student loans forgiven through the Public Service Loan Forgiveness program. These changes only last until October 31, 2022, and you have until December 31, 2023, to apply for the actual debt relief plan. At first, the Education Department said any loans it holds would qualify, which would mean 5 million borrowers who have a commercially owned Federal Family Education Loan could’ve been left out. Still, the Department is looking for a possibility to collaborate with private lenders to ensure the student loan forgiveness can also help commercially held federal student loan borrowers. Those people will have more than a year to apply, and private student loans are excluded from President Biden’s plans. Student loans won’t be included after June 30, 2022, and applications will be open in October of this year. The student loans won’t trigger a federal tax bill because of the American Rescue Plan of 2021, which made student loan forgiveness tax-free and ends in 2025, which the law also covers Biden’s forgiveness plan.

Rachel Lewis (Social Studies Department) said, “Honestly, I don’t know, I think it’s great because, of course, who doesn’t want some relief for student loans, and I think a lot of times when people think those loans, well kids are super young, they don’t know what you’re signing up for but at the same time it’s worrisome about whose paying for that and how it’s going to be paid and given that like everything is so expensive right now it’s scary because if things get more expensive it will become harder and harder for people to just survive. It could make it so that it’s more difficult for people in your generation to get into college because now they know a certain percentage will get their loans forgiven, but it can also make enrollments go up, which is another thing, especially for certain colleges like private institutions. They can open the door for a lot of students to be able to go to college because now they know they’re getting help financially. It really could change college trajectory down the road. It also could make it so that, like I know HBCs a lot of them fail sometimes because they don’t have the money because they don’t have student enrollment so they end up having to close the door but because students are getting that financial help that may help them have a higher enrollment to keep their doors open.” Dr. Joel Howell (Science Department) said, “My thoughts on the student relief? I think it’s good that people are getting student relief but the problem is they’re still making student loans so you’re helping these people but the next generation are going to have student loans just like this generation did and who’s going to pay for it. Someone’s gotta pay for it, you know money just doesn’t grow on trees so obviously someone’s gotta be tapt in order for other people getting a free education for $10,000. It would put my kids in debt, so my kids will be paying for this generation’s debt, my kids who are 9 and 7, will be paying for my generation’s debt which is unfair to them. I’d think it would be better instead of giving people debt. Maybe put student loan interest at zero so that they’re not paying any interest, but they’re still paying their debt off, but it’s not accumulating more debt so just put the interest at zero.”

Leigh Kuhn (Career Technology Department) said, “I believe college costs have been crazy, the jump. It’s kind of a business now where people try to make money. Particularly, companies that loan, they try to make money off the interests of students which keeps young people who know they have to get a college degree in order to get ahead in life and to have a salary, to healthcare, start families and buy homes and they’re waylaid by hundreds of thousands dollars of debt sometimes. Some people only got loaned 20 to 30 thousand dollar loan but the interest which is at a crazy percent level compounds that to what they owe into often two, two and a half times more than 30 grand. So, they might have paid the 30 grand but because of the interest and the extended time it takes to pay off a loan when you’re finally getting your first job, they never get out of debt. The consequence of this is we have fewer and fewer students that require loans actually getting out from underneath that debt and being able to purchase homes, leave generational wealth to their families, purchase goods and services in the economy. So the effect on the economy is very, very poor. Now, everyone thinks that it’s tax payers dollars providing these loans for people but it’s also tax payers dollars that provide loans to the military to buy let’s say defense equipment and to the military to buy all kinds of things. Now, I’m pro-defense, but I’m also pro-economy and if our country was smart, they’d go ahead and realize that if they were to forgive this insanely over the top student debt, it would actually contribute to our economy by making more of these young people, who are buried under debt, be able to spend money, purchase homes, purchase goods and services, purchase cars. It adds to the economy, it helps all of us. A lot of old people think ‘how do they get theirs forgiven but I don’t?’ the United States is an experiment where we are a community, an extremely large one. The only way we can work is if we think collectively, what will help all of us, not just what’s going to help me and ‘that’s not fair, ‘where’s mine, and ‘you shouldn’t get yours’ that’s not the way to think. They’re thinking about this the wrong way. Obviously, it’s better for us as a nation to have young people to be able to purchase homes and cars, and get out of debt, and build families, and build careers, and find cures for cancer, and make it to the moon, and whatever it is they want to do. We want a college educated population, and we want them to be out of debt, and we need them to be old people, anybody who is old, who is thinking, ‘no, it shouldn’t, why should I pay for them?’ That’s not what’s happening. It’s the same as social security. Social security is funded by tax dollars, you know what I mean? And you’re paying into it. It’s the way the United States works. That’s the way this experiment works and the only way for it to be successful is to get our young out of the debt they have compounded that is helping no one. It’s not helping us either, it’s really dragging us down as a society. All student debt not only should be canceled but we should be thankful that it’s even an option and someone’s willing to consider it. We need young buyers in our economy and that’s the way to do it. They can’t buy anything if they’re saddled with 200 thousand dollars worth of debt because they did what they were supposed to do, what we wanted them to do, go to college, get a degree, and become contributors, prospering in society. The most important single contribution that is in the future, is not the only economy that’s a very limited view. It’s the generational wealth that is being passed down to the people of color. We’re talking black, native American, Hispanic, Asian, anyone who came to this country who is a child or grandchildren of immigrants or beyond that did not have to step that many white college students were able to get. Their families get loans easier, it is been traditional history of when a bank gives a loan to someone and so we need people of color to be able to develop generational wealth, property, real estate and for them to do that they need not to be saddled with debt for 20 to 30 years of their life.”

Dawn Marotta (Science Department) said, “I think it’s great. I think the people who are going to receive the most benefit, the most relief from it, need it. And it’s going to make a big difference to their future. It could set a good precedent, maybe not to be completely replicated in the future but it hopefully will eliminate the fact that student debt is a huge problem and it’s a huge barrier for a lot of talented youngsters who deserve an opportunity to go to college and might not because of financial reasons.” “To be honest, as a person who had a student loan that didn’t get forgiven, I personally think that people should have to pay back all their loans when they take one out. So, I think I’m completely against it and on top of it all it’s going to do is cause us to pay more taxes. As a tax payer I’m not happy with it either. However, as a parent, if my kids had a loan I’d be happy with it. It depends on where you stand. Students may take out more loans thinking that they are going to be forgiven down the road and it’s going to affect the tax favors because in reality, they’re the ones the loans back. It’s not like the money disappeared. Somebody still has to pay the loan and it affects taxpayers down the road.” Melissa Winston (Math Department) said.

With mixed thoughts and concern about President Biden’s debt relief plan, student loan relief, which the US Department of Education will provide, will be $20,000 in debt cancellation to Pell Grant recipients and $10,000 in debt cancellation to non-Pell Grant recipients. Applications are open as of October this year and have until December 31, 2023. However, people who commercially hold Federal Family Education Loan have until 2024 to apply

Lily Francois is a senior and a third year journalist at Wheeler High School. She is from Trinidad, an island in the Southern Caribbean close to the continent...